940 Printable Form - In this guide, we’ll give you an. Unlike other federal payroll taxes — such as. If you’re an employer who’s required to pay federal unemployment tax, you’ll need to complete and file a form 940 with the irs every year. Form 940, employer's annual federal. Learn how to complete the irs form 940 to report federal unemployment tax payments and taxes owed, as well as information about state unemployment taxes. Form 940, employer’s annual federal unemployment tax return, is an irs form that employers use to report any futa tax payments they’ve made over the course of the calendar. Together with state unemployment tax systems, the futa tax. Use form 940 to report your annual federal unemployment tax act (futa) tax. Form 940 is an irs document filed by employers once a year to report their federal unemployment tax act (futa) tax liability.

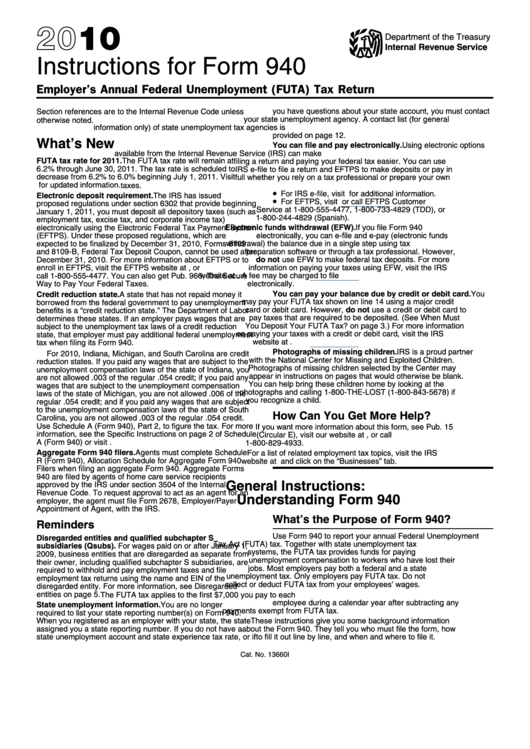

Instructions For Form 940 Employer'S Annual Federal Unemployment

Learn how to complete the irs form 940 to report federal unemployment tax payments and taxes owed, as well as information about state unemployment taxes. In this guide, we’ll give you an. If you’re an employer who’s required to pay federal unemployment tax, you’ll need to complete and file a form 940 with the irs every year. Use form 940.

Form 940 Employer's Annual Federal Unemployment (FUTA) Tax Return

In this guide, we’ll give you an. Form 940, employer's annual federal. Unlike other federal payroll taxes — such as. Use form 940 to report your annual federal unemployment tax act (futa) tax. If you’re an employer who’s required to pay federal unemployment tax, you’ll need to complete and file a form 940 with the irs every year.

How to Fill Out Form 940 Instructions, Example, & More

Form 940 is an irs document filed by employers once a year to report their federal unemployment tax act (futa) tax liability. Form 940, employer’s annual federal unemployment tax return, is an irs form that employers use to report any futa tax payments they’ve made over the course of the calendar. Use form 940 to report your annual federal unemployment.

How to File Form 940 FUTA Employer’s Annual federal Unemployment Tax

If you’re an employer who’s required to pay federal unemployment tax, you’ll need to complete and file a form 940 with the irs every year. Learn how to complete the irs form 940 to report federal unemployment tax payments and taxes owed, as well as information about state unemployment taxes. Together with state unemployment tax systems, the futa tax. Form.

Printable Form 940

Learn how to complete the irs form 940 to report federal unemployment tax payments and taxes owed, as well as information about state unemployment taxes. Form 940 is an irs document filed by employers once a year to report their federal unemployment tax act (futa) tax liability. Unlike other federal payroll taxes — such as. Form 940, employer's annual federal..

Fillable Form 940 Employer'S Annual Federal Unemployment (Futa) Tax

Form 940, employer’s annual federal unemployment tax return, is an irs form that employers use to report any futa tax payments they’ve made over the course of the calendar. If you’re an employer who’s required to pay federal unemployment tax, you’ll need to complete and file a form 940 with the irs every year. Form 940, employer's annual federal. Form.

Instructions For Form 940 Employer'S Annual Federal Unemployment

Form 940 is an irs document filed by employers once a year to report their federal unemployment tax act (futa) tax liability. Form 940, employer's annual federal. Unlike other federal payroll taxes — such as. In this guide, we’ll give you an. Form 940, employer’s annual federal unemployment tax return, is an irs form that employers use to report any.

940 Form 2022 Fillable Online And Printable Fillable Form 2024

Unlike other federal payroll taxes — such as. In this guide, we’ll give you an. Form 940, employer’s annual federal unemployment tax return, is an irs form that employers use to report any futa tax payments they’ve made over the course of the calendar. Form 940, employer's annual federal. Form 940 is an irs document filed by employers once a.

Learn how to complete the irs form 940 to report federal unemployment tax payments and taxes owed, as well as information about state unemployment taxes. Unlike other federal payroll taxes — such as. Form 940, employer's annual federal. Together with state unemployment tax systems, the futa tax. In this guide, we’ll give you an. If you’re an employer who’s required to pay federal unemployment tax, you’ll need to complete and file a form 940 with the irs every year. Form 940 is an irs document filed by employers once a year to report their federal unemployment tax act (futa) tax liability. Use form 940 to report your annual federal unemployment tax act (futa) tax. Form 940, employer’s annual federal unemployment tax return, is an irs form that employers use to report any futa tax payments they’ve made over the course of the calendar.

Learn How To Complete The Irs Form 940 To Report Federal Unemployment Tax Payments And Taxes Owed, As Well As Information About State Unemployment Taxes.

Form 940, employer's annual federal. Unlike other federal payroll taxes — such as. Form 940 is an irs document filed by employers once a year to report their federal unemployment tax act (futa) tax liability. Use form 940 to report your annual federal unemployment tax act (futa) tax.

Form 940, Employer’s Annual Federal Unemployment Tax Return, Is An Irs Form That Employers Use To Report Any Futa Tax Payments They’ve Made Over The Course Of The Calendar.

In this guide, we’ll give you an. Together with state unemployment tax systems, the futa tax. If you’re an employer who’s required to pay federal unemployment tax, you’ll need to complete and file a form 940 with the irs every year.